Timor Resources, which is backed by Australian company Nepean Group, has pledged to spend up to $150 million in order to explore and develop for oil, and it believes that production could be established within just four years.

Nepean has more than 12 specialised businesses in manufacturing, mining, construction and transport and is valued at more than $400 million.

Timor Resources is headed up by long-time Nepean employee Suellen Osborne, who brings the investment and management skills, while former Central Petroleum executive Mike Bucknill is leading the exploration effort and bringing some experience in commercialising oil and gas projects.

Energy News understands Timor Resources was successful in finalising a farm-in with Timorese-controlled Timor Gap because it was a medium-sized firm willing to co-operate on an equal basis.

For Bucknill, it is a chance to bring his skills on a promising but largely unexplored region.

"In a sense this is me coming full circle, because I worked at Esso on Jabiru and Challis in the Timor Sea 30 years ago," Bucknill told Energy News yesterday.

He said there were some analogies in the Triassic and Jurassic targets that had been so successful in the Timor Sea, although they are structurally different onshore, and what he had seen of prior exploration had been extremely promising.

East Timor was a Portuguese colony between 1769 and 1974, but was conquered by Indonesia in 1975 and was ruled from Jakarta until independence in 2002.

As a result of the occupation and an active resistance movement, for more than four decades there has been little exploration of East Timor's hydrocarbon potential, although its location has supported numerous academic studies all highlighting the potential of the nation.

Bucknill is now working to purchase and collate all the existing data.

While there had been sporadic drilling in the early 1900s, the first real systematic exploration was undertaken in the 1960s, which includes a number of wells such as Matai-1A, Cota Taci-1 and Suai Loro-1 that sit within Timor Resources' new areas that can still produce limited rates of oil, plus some vintage 2D seismic in 1969.

Pertamina collected more widely-spaced seismic in 1994, but never drilled, most likely because of the risk of guerrilla attacks by Timorese rebel groups.

"It is widely spaced, 3-6km, so we don't know much will be useful, but we think we can reprocess about 300km, and that should help us with our own 2D plans," Bucknill said.

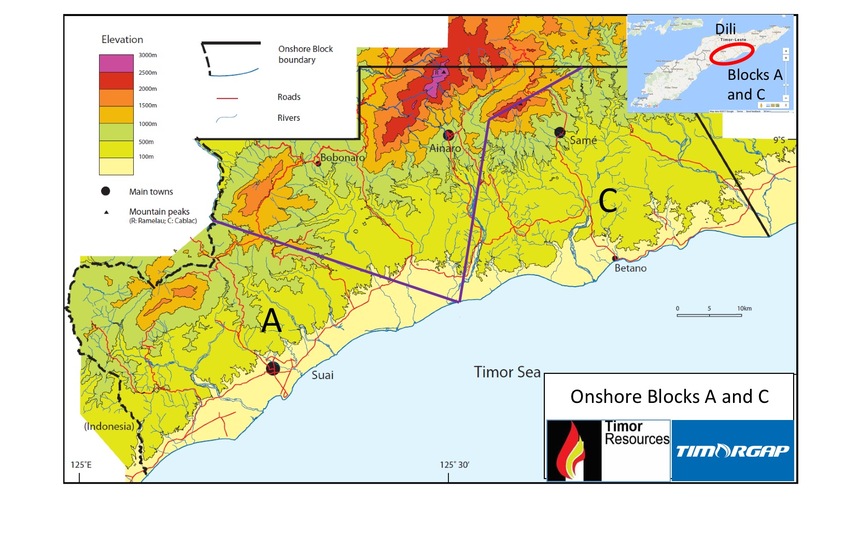

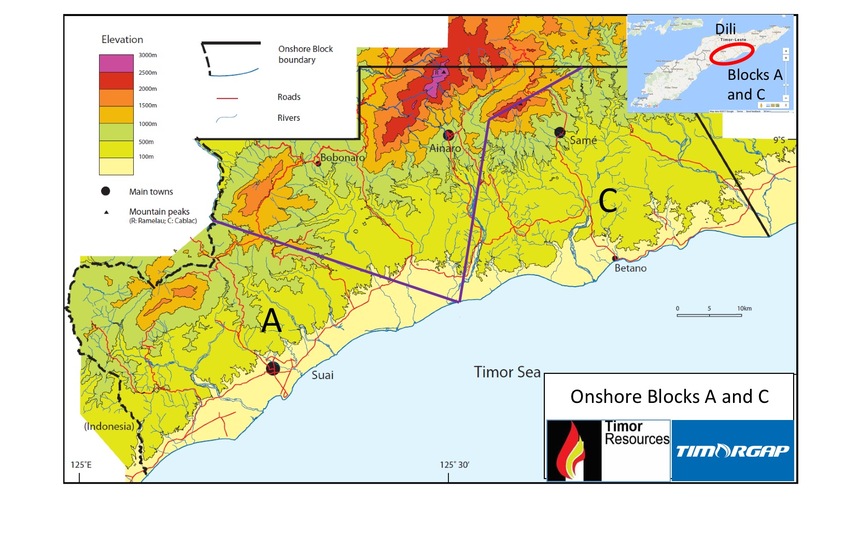

The Timor team was on the ground in Dili over the weekend, signing the first agreement for onshore oil and gas exploration over Block A and Block C, where there are some 60 documented oil seeps.

The company elected not to farm-into Block B, which contains almost two dozen gas seeps on the Bazol anticline in the Block B, because conditions more akin to the Highlands in PNG and exploration would be less attractive from a cost point of view.

The PSC was signed by Nepean chairman David Fuller, Autoridade Nacional do Petróleo e Minerais president Gualdino Da Silva and Timor Gap director Norberta da Costa in the presence of prime minister Doctor Rui Maria de Araújo and Australian ambassador Peter Doyle.

The award of the onshore blocks has been more than a decade in the making.

It is now the only company in the world with the rights to explore within East Timor, although there are considerable reserves within the Joint Petroleum Development Area, and within the Indonesian province of Timor.

"The Timorese Government recognises that this project has the potential to bring life-changing benefits to its people," Fuller said.

"They don't have the resources to fund a development of this size alone so they have been looking for a partner who is prepared to share the risks and the rewards - a partner they can trust and who will work in a partnership.

"An investment of this size is always an enormous challenge. But beyond the potential economic benefits, this is a chance to really make a difference in people's lives."

Bucknill said the first order of business would be to assess the known seeps within the 2000sq.km areas, with the aim of shooting 900km of 2D seismic next year.

"Onshore Timor offers very good potential, as it is largely unexplored, yet it has the elements of an effective hydrocarbon system," Bucknill said.

"You just need to look to the region and the prospectivity of the offshore activity to see the potential. Oil has been recovered from seeps and pits all along this coast."

He said the company has already identified multiple targets and play types, where there appears to be 25-35 degree API gravity oil with low sulphur levels.

Timor Resources and Timor Gap are planning to drill two wells in each block in year three of the two permits, and work has already begun on assessing the rig options.

Bucknill said drilling could involve either minerals rigs fitted up for slimhole drilling, or a big rig to probe into the deeper stratigraphy.

It will ultimately depend on the seismic, however the deepest well in Block A is just 2900m, while Block C has little drilling beyond the upper stratigraphic levels, so the question of the best potential reservoirs is wide open.

Bucknill said wells could cost between $US3-7 million each because on current estimates.

Onshore Timor-Leste contains large anticlinal structures with associated oil and gas seeps, which have the potential to hold significant hydrocarbon accumulations.

Estimates by Timor Gap suggests the potential for 857 million barrels of recoverable oil (unrisked), which would be more than enough to meet local demand, which requires spending around $140 million on importing refined petroleum last year.

The onshore licence comes as East Timor's major source of revenue, Bayu-Undan, moves towards depletion and the Kitan oil field has already been shut in.

Further, the ongoing diplomatic dispute with Australia over the location of the maritime border has stopped any progress on the development of the Greater Sunrise field, where the leases are due to expire in 2026.

Timor Resources' partner Timor Gap has a mandate to implement the Tasi Mane project - a three-cluster development project to support onshore hydrocarbon production through construction and operation of a refinery, petrochemical plant, LNG plant and a network of petrol stations to ensure fuel distribution across Timor.

So far support along villages has been positive, and Timor Resources' licence terms include local content and employment provisions, Bucknill said.