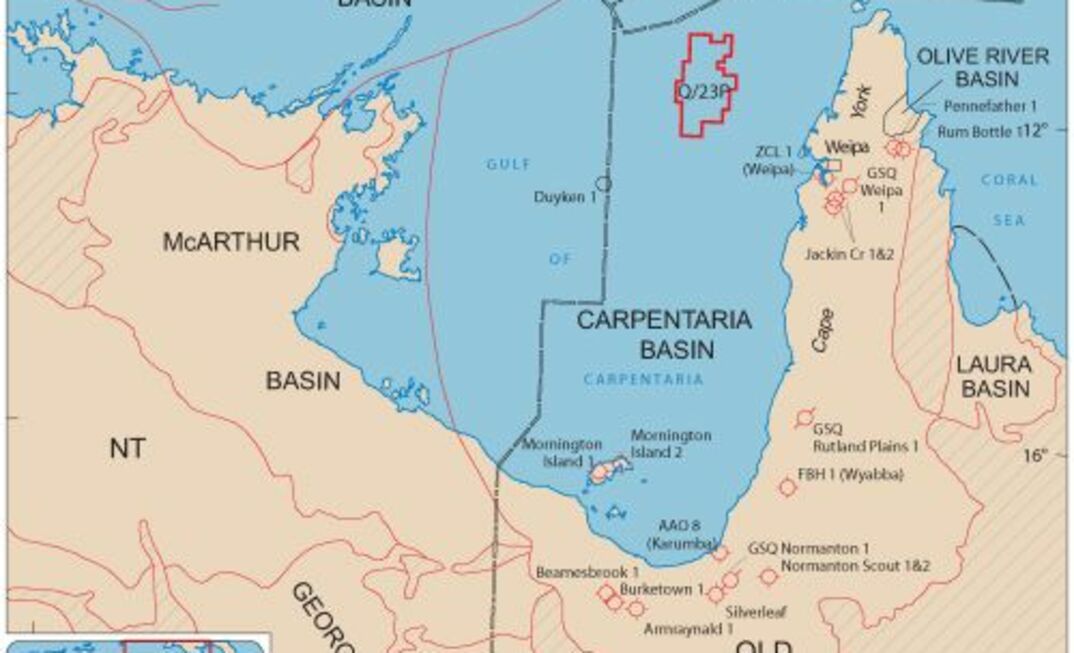

To the surprise of many, Advent Energy managed to get a well drilled in PEP 11 in the offshore Sydney Basin a few years back with disappointing results, slowing the pace of offshore NSW exploration, while further around the coast Q23/P in the Gulf of Carpentaria continues to simmer, a puzzle that Gulf Energy is hoping to unlock.

Gulf's managing director Wolfgang Fischer told Energy News that after a decade of exploration the time was approaching to finally spud a well.

It's been a hard slog for the company over the past decade, with the privately funded wildcatter carrying most of the costs of exploration, which so far has involved a lot of deep geological and geophysical well and large, modern 2D seismic surveys.

Q23/P has just been renewed by the Commonwealth for its second five-year term, over 50% of the previous area, although it isn't like licences offshore Queensland are in high demand.

The privately-owned Gulf has the only offshore block in the state, and to date the company has managed to meet all of its work commitments.

Gulf had hoped to fund its extensive seismic programs with a farm-out, however the global financial crisis slowed things down overall.

"We were looking for JV partners a few years ago, but in the end we found some investors who were interested in pre-IPO investment, primarily North American and European investors," Fischer, a former ExxonMobil geologist, said.

The funding allowed the explorer to complete two seismic surveys, a regional shoot in 2012 and an infill survey last November.

"We have just finished the interpretation and we have highlighted a number of leads and prospect," Fisher said.

That means Gulf will again saddle up and hit the farm-out trail, in one of the worst markets in recent memory, but despite that Fisher told Energy News that the company had baited its hook, and had some nibbles already.

"What we are offering is kind of unique in that it is an undrilled basin," Fisher said.

"It's got older rocks, Palaeozoic-aged, and there are some pretty big features in there, and the upside volumetrics are pretty enormous.

"It's in only 60m of water and 100km offshore, so the exploration and development costs will be at the lower end of the curve."

Drilling in the Bamaga Basin, which sits under the Jurassic-Cretaceous-age Carpentaria Basin, requires a partner with unorthodox thinking, but he is convinced the right partner is out there, willing to take a punt on an untested idea.

Once mapping of the 2D is complete the next step will probably be having Gaffney Cline complete an independent resource estimate.

Gulf will then really start knocking on doors, seeking a partner or partners willing to fund the drilling.

If all goes well and the market conditions are supportive Gulf is planning to complete an initial public offer next year, or it could look at a backdoor listing.

Then it will probably shoot a 3D seismic survey to help better map some of the complex geology and help define additional traps and the best well candidate locations.

"Given the way the price of 3D seismic has gone, I think it would be a smart investment. You used to pay $20,000 per sq.km for more, and you can now get it for $5000/sq.km or less, and we have been talking with a number of contractors who are keen to help us out," he said.

Fischer said there are few undrilled basins anywhere in the world, which makes Gulf unique.

"You have the Seychelles with WHL Energy, but that isn't close to a market, infrastructure or support services, and you have the Falkland Islands, which has all of those problems and sovereign risk," he said.

"Our upside and the relatively low cost make it interesting place to work."

One of the big issues in the area is the lack of past drilling.

There has been a single well into the Gulf of Carpentaria, Duyken-1, which was not only drilled on drilled on poor quality seismic, but it did not drill deep enough to penetrate the Bamaga Basin.

It means a lot of Gulf's work started as mere conjecture.

"We just really don't know the ages of the rocks. We think they are in the Palaeozoic, and we're not looking at the Proterozoic," Fischer said.

"We're not sure what analogues there we are. We have defined a number of Palaeozoic basins in Australia and elsewhere, but we really won't know until we drill.

"We think this is a great place to play, and if you look at Australia, particularly a presentation done by Marita Bradshaw, who used to be with Geoscience Australia, Australia's undiscovered potential probably is in the older rocks that really haven't been drilled up that much.

"Where they have explored for the Palaeozoic it is in the onshore, and that is pretty hard to do because the costs and logistics of drilling and seismic are harder."

However the potential for Palaeozoic basins around the well is well recognised, particularly in Africa and North America.

Fisher says work done by Geoscience Australia indicates there could be up to 4000m of sediment in the Bamaga Basin, so Duyken-1, a duster drilled in 1984 in the centre of the basin, remains an invalid test of the Palaeozoic and Mesozoic strata.

"One thing the Duyken -1 well does tell us, despite the fact it didn't penetrate the Bamaga Basin, is that in the middle of the Gulf, you have source rock down there that is mature for oil in the shallow section, and going down into the gas potential," he said.

"It is risky, but there is big upside potential because you can make money from oil or gas in that part of the world."

Gulf's enthusiasm shows in its seismic commitment. It originally planned 800km of 2D and has now shot some 5500km, and it has only detailed around half of its area.

The prospects covered with seismic to date are "the best of the bunch", he said.