Key Petroleum has a 40% interest alongside operator Pilot Energy (60%) in the highly prospective permit, and under the required work program, the venture will need to reprocess seismic and acquire new seismic.

In its fourth year Key will need to begin well planning with a view to drilling the first exploration well in 2024.

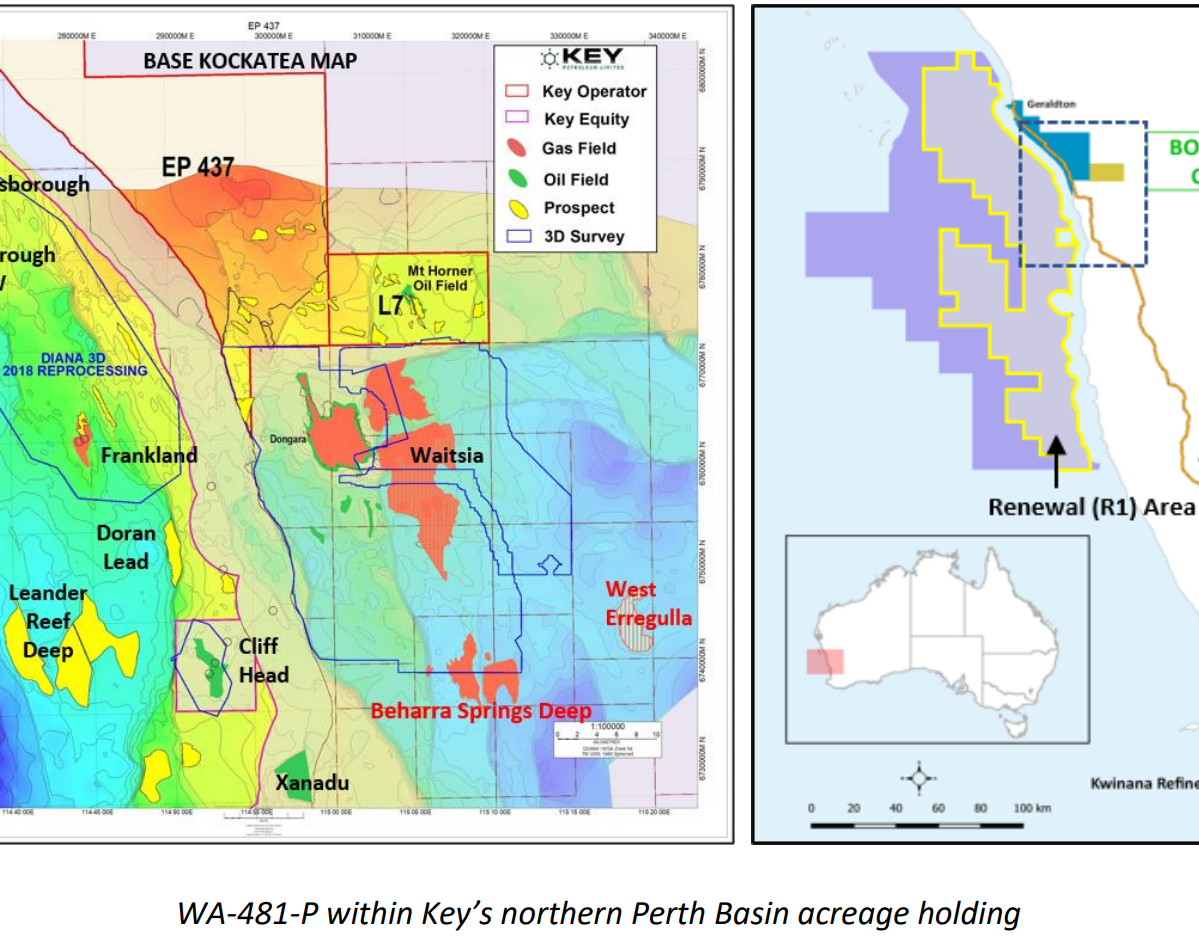

The permit covers an area of 17,457 km2 in water depths mostly within 5 - 200m. It is also directly adjacent to the producing Cliff Head oil field operated by Triangle Energy.

A highlight of the area is that it includes the Dunsborough oil and gas discovery, and gas discoveries at Frankland and Perseverance.

Key and Pilot both believe the exploration permit could hold similar reservoirs to that of Waitsia and West Erregulla.

"The offshore renewal area is believed to contain the same deeper Permian High Cliff and Kingia Reservoirs where significant gas discoveries have been recently reported nearby in the onshore portion of the northern Perth Basin," Key said this morning.

If the venture shores up their prospects, the first exploration well is expected to cost up to $15 million. If the well goes ahead, Key will be one of three active players in the offshore Perth Basin.

Last week in an unrelated matter, Key claimed one of its other joint venture partners had failed to pay a cash call and had thus acquired its interest in the L7 onshore production license.

Key and Triangle Energy both had a 50% interest in L7 which contains the Mount Horner oilfield.

Key told investors late earlier that Triangle owed it A$77,000 and had earlier issued the company a cash call for the money owed. It claimed the cash call had gone unanswered and it had not received the cash, and that as a result, Triangle's 50% stake in the L7 permit had reverted back to Key.

Triangle "strongly refutes" the validity of the cash call, work program and budget upon which the initial cash call was based.