Karoon Energy's share price rocketed 16% this morning and it was trading at 77 cents per share giving it a market cap of $368 million at noon today, after it announced it had signed an amended sale and purchase agreement.

The ASX-listed operator first inked a deal to buy up the massive oil field from Brazil's state oil company Petrobras in July last year, for US$665 million (A$933M).

It will pay US$380 million after the closing of the deal and a contingent payment of $285 million over a period between 2022 and 2026.

Should the oil price recover to over US$100/bbl in 2020 Karoon will pay an additional US$50 million to Petrobras.

It is one of the largest international asset acquisitions made since the oil price crashed in April this year and comes as Brazil's government looks to offload large upstream assets to balance its books and bring Petrobras back into the black. The sale should close in the third quarter of this calendar year.

Importantly, under the new acquisition agreement, Karoon will avoid requiring debt financing. The new terms defer the bulk of the overall payment out to 2022-2026 which can now be paid out of cash flow from the field.

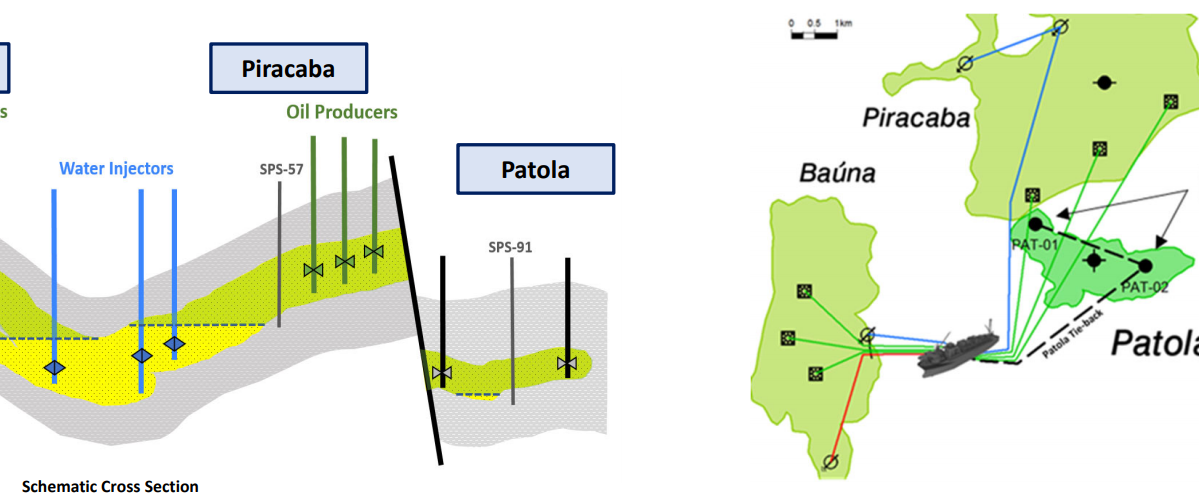

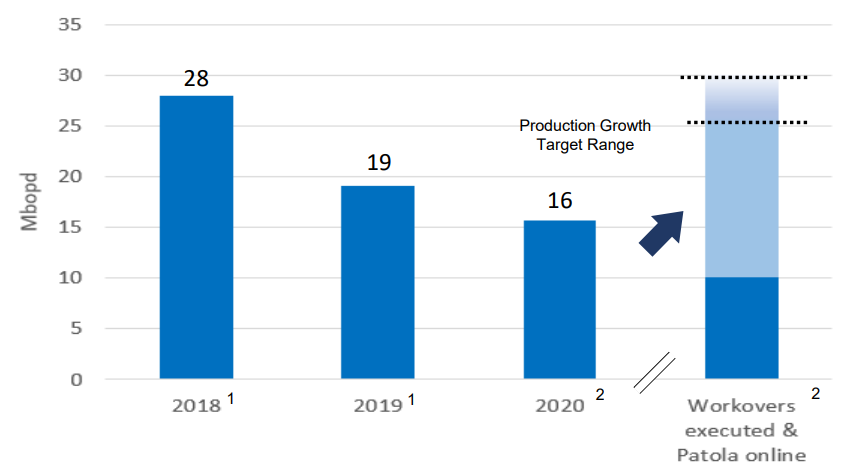

The Bauna field currently produces around 16,000 barrels of oil per day, but Karoon is bullish about further development opportunities, with plans to tie in two new nearby discoveries to boost production.

Bauna holds 2P reserves of 46.8MMbbls and produces from six wells tied back to the Cidade De Itajai floating production storage and offloading (FPSO) vessel. Karoon believes the field could hold 2C contingent resources of 101.8MMbbls of oil if untapped prospects are developed.

The Patola undeveloped discovery is estimated to hold 15.6 million barrels of oil, and a recompletion of another well located on the field will add another 4.2MMbbls, based on 2C resources estimates.

"Despite the changed environment, this revised agreement delivers the benefits we always wanted from acquiring a producing asset including immediate cash flow, reasonable terms, management of risk, and opportunity for the future," Karoon managing director Robert Hosking said in a statement.

"Karoon has assessed several opportunities as part of its broad ranging strategic review and this revised deal for Bauna has proven the best outcome for shareholders on an overall valuation and returns basis."

Post-acquisition, Karoon believes it will remain in a strong financial position, with approximately US$130 million in cash.

Despite the low oil price, with Brent Crude sitting at around $40/bbl, Karoon said Bauna oil remained cash flow positive.

BTG Pactual and RBC Capital Markets acted as advisors to Karoon on the acquisition.

Following Karoon's announcement to the market, KBC analyst Gordon Ramsay said based on his estimates the company would generate between US$200 million and $300 million in free cash flow in 2023.

"Under the new terms announced today, we expect the total upfront payment to be ~US$200m (inclusive of the consideration payable 18 months after closing date). Karoon currently has US$280m in cash as at 30 June 2020," Ramsay said.

"We view the new terms as materially positive. In our view this development significantly derisks Karoon, as it now becomes an unhedged oil producer that is not affected by restrictive debt financing terms."