However it has restarted the climate debate after a few months when issues had simmered down as the country dealt with the immediate effects of the pandemic and tried with limited information to assess its economic impact.

But even as COVID-19 was first breaking in Wuhan, the government was clear it wanted to see more onshore gas development, coming to a deal with New South Wales for it to delivery 70 petajoules per year of gas into the domestic market, ideally via Santos' Narrabri CSG project, which aims to produce that amount.

Santos, APPEA, the Australian Gas Infrastructure Group, the Australian Gas Pipeline Association, have all welcomed the move.

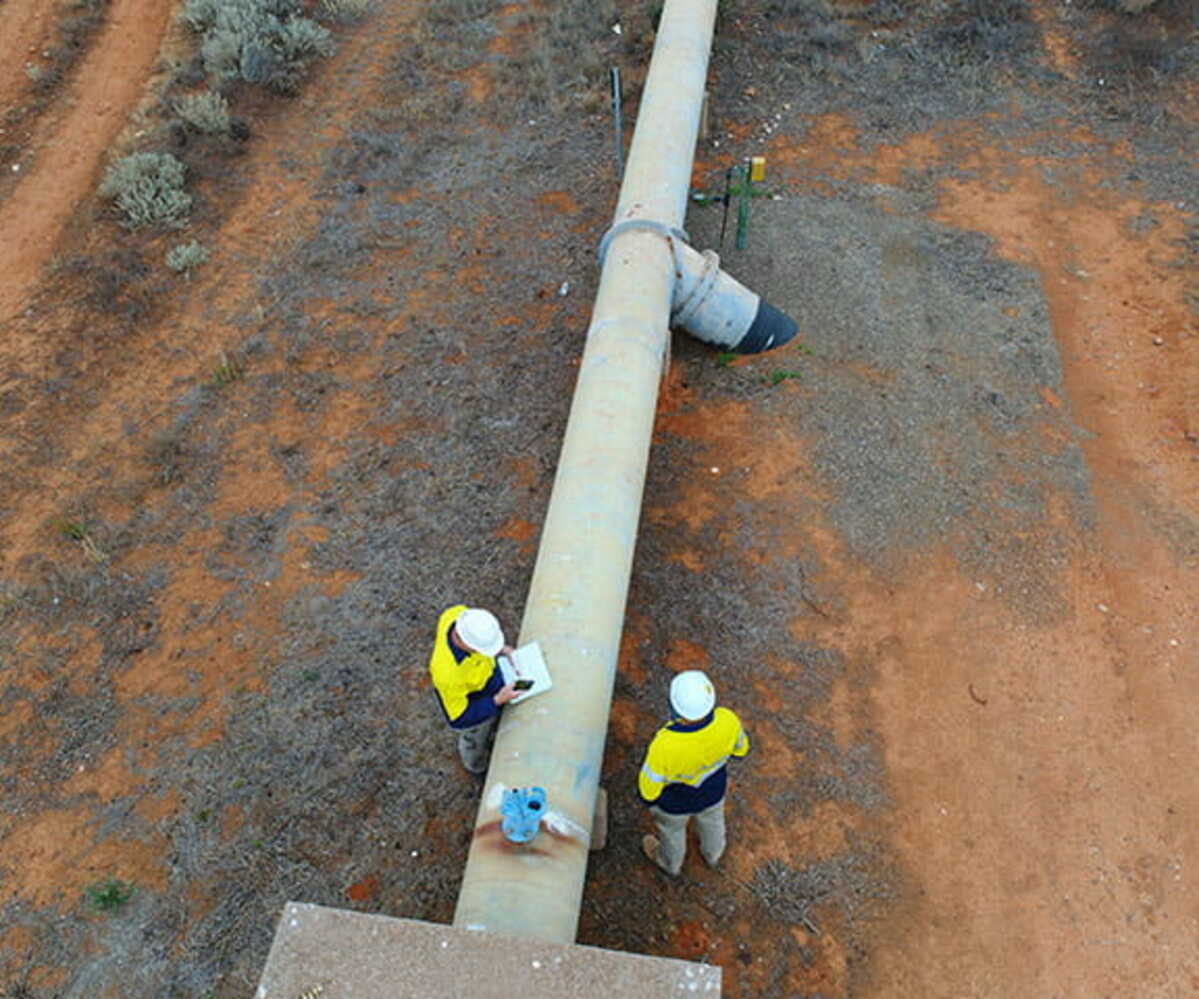

"The prime minister's National Gas Infrastructure Plan is very welcome because there are missing pipeline links that are needed to connect new projects like Narrabri and new basins like the North Bowen, South Nicholson in Queensland and Beetaloo in the Northern Territory," Santos CEO and APPEA chairman Kevin Gallagher said.

The oil and gas lobby has welcomed government policy - some of the most interventionist the government has put forward in the sector - despite last year saying market intervention may affect industry confidence.

"Market interventions could adversely affect confidence in the oil and gas sector as well as discourage new market entrants and supply diversity," APPEA chief Andrew McConville said in July 2019, though today welcomed the confidence in his industry shown by the government.

Meanwhile The Grattan Institute's Tony Wood said the policy was "government intervention on steroids."

Grattan is a centrist think tank based in Melbourne and Wood had worked in industry for years before joining.

It has previously been critical of either a gas-fired recovery or the idea a renewables boom could save Australia, post-COVID-19.

"We're not going to get cheap gas below $6 per gigajoule and even if we did it's not going to create a new industry as they only employ so many people."

"If cheap prices led to a manufacturing boom, we'd have already had one."

He said the government's plans to recreate the US Henry Hub trading hub, which acts as a spot gas price benchmark for the region was "nonsense" given the hundreds and thousands of suppliers and buyers of gas in the US compared to the dozens in Australia.

The Clean Energy Council, the Australasian Centre for Corporate Responsibility, and companies like Infinite Blue Energy have all lambasted the plan for its reliance on fossil fuels and avoidance of driving investment into new energies at a time when the planet's climate is, they say, getting worse.

The Clean Energy Council said the policy would introduce further uncertainty on energy policy, particularly given the government's previous policy - Underwriting New Generation Investment scheme - has yet to get off the ground two years after it was announced, and is completely at odds with the government's technology neutral approach.

The ACCR made similar criticism, noting the government's long track-record of saying Australia's energy mix should be decided by the market, but instead the government is now preparing to "throw millions of dollars at a failing industry".

"The federal government may have finally given up on thermal coal but the carbon lobby won't be deterred, by pushing gas, another dirty fossil fuel - which is proven to have the same, if not worse emissions than coal once fugitive methane emissions are factored in," ACCR director Dan Gocher said.

Infinite Blue Energy, which is building a commercial-scale renewable hydrogen project in Western Australia, described the plan to build a gas-fired generator as "short-sighted", noting the government's green hydrogen plans inked with Germany last month, as having more financial promise longer term.

"Why is Australia so reluctant to support green hydrogen, when there are an abundance of renewable energy that enables us to produce the cheapest green hydrogen in the world," Infinite Blue Energy CEO Stephen Gaul asked.

Ultimately the whole thing, from the new dispatchable power plant to the plans to build more pipelines will likely kill investment as industry sees a strong signal of nationalisation, and from a Liberal government, is nothing more than "a stampeding herd of white elephants," Wood said.