Backed by some of the world's most powerful investors, Massachusetts-based Commonwealth Fusion Systems says its SPARC machine could deliver on the long-promised vision of limitless, carbon-free power far sooner than expected.

While the US, China, the EU, Japan, South Korea and India are pouring billions into strategies to commercialise fusion by the 2040s – but CFS's $863 million cash injection has raised the stakes, pushing the technology from the realms of science fiction toward industrial reality within a decade.

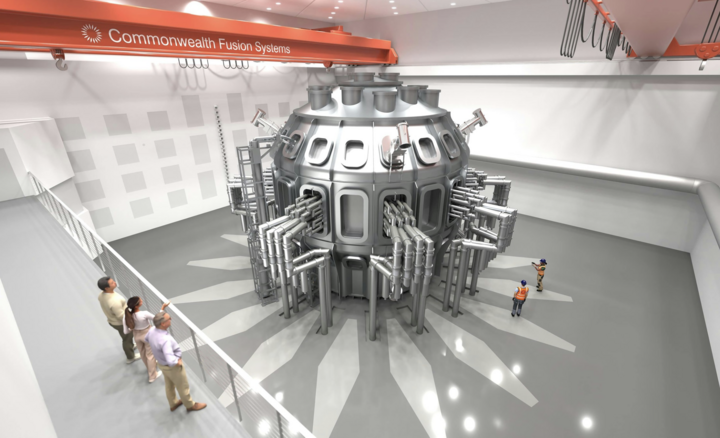

Spun out of MIT in 2018, the US company has now secured almost $3 billion — about a third of all private fusion funding worldwide. The latest round will fund completion of its SPARC demonstration reactor and accelerate development of ARC, billed as the first grid-scale fusion power plant, to be built in Virginia.

Fusion crosses the threshold

YOU MIGHT ALSO LIKE

"Investors recognise that CFS is making fusion power a reality," said CEO Bob Mumgaard.

"This funding demonstrates CFS' leadership role in developing a new technology that promises to be a reliable source of clean, almost limitless energy."

The oversubscribed round pulled in a diverse mix of backers, from hedge funds and sovereign wealth funds to industrial conglomerates and tech giants. Notable names include Google, Morgan Stanley's Counterpoint Global, NVIDIA's NVentures, and billionaire Stanley Druckenmiller.

A 12-strong Japanese consortium led by Mitsui & Co. and Mitsubishi Corporation also joined the fray, with participation from the Development Bank of Japan, JERA, and Kansai Electric.

CFS already counts Breakthrough Energy Ventures, Eni, Khosla Ventures, Emerson Collective and Hostplus among its largest backers, many of whom increased their stakes. The latest round further broadens the company's global footprint across finance, industry and government.

The turning point to belief

"Few technologies in our investable universe have the potential to reshape the global energy system – and therefore the climate trajectory – as profoundly as fusion power," said Frédéric de Mévius, executive chairman of Planet First Partners.

Vinod Khosla of Khosla Ventures called CFS' ARC plants "limitless energy to fuel the age of AI driving a new wave of societal transformation."

Laurene Powell Jobs, founder of Emerson Collective, said humanity "for the first time has a real opportunity to commercialise the long-held promise of fusion power".

Dennis Lynch, head of Counterpoint Global at Morgan Stanley, described the venture as a rare mix of "visionary leadership, scientific breakthrough and executional excellence" in one of the world's biggest markets.

The projects: SPARC and ARC

At its Devens site in Massachusetts, CFS is completing SPARC — a prototype reactor designed to achieve "net energy gain," meaning it produces more power than it consumes. The machine leverages advances in high-temperature superconducting magnets, a breakthrough that dramatically reduces the size and cost of fusion systems.

In parallel, the company is preparing to build ARC, a commercial-scale fusion plant in Chesterfield County, Virginia. Developed in partnership with Dominion Energy, ARC is scheduled to supply the grid in the early 2030s. Google, both an investor and customer, has already agreed to purchase half the electricity produced.

The bigger picture

For decades, fusion has been the "holy grail" of clean energy: the same process that powers the sun, offering abundant, carbon-free electricity without long-lived nuclear waste. Yet efforts have largely been confined to government-backed science projects.

Private money is now racing ahead. CFS's ability to consistently attract capital signals confidence that the industry is nearing commercial inflection. The company has turned breakthrough science into an execution playbook, moving faster than publicly funded programs like ITER in France.

"Energy has always been the foundation of human progress," said Powell Jobs.

"To meet the challenges of this century, we need energy that is abundant, clean, and accessible everywhere. That's what fusion offers."

A global bet

Japan's entry into the investor roster showcases fusion's strategic dimension. Its involvement links energy utilities, banks and shipping companies, pointing to a potential new industrial supply chain. European investors, Middle Eastern financiers and U.S. pension funds also feature, highlighting fusion's emergence as a global race.

Eni, which calls itself CFS' relative majority shareholder, described the technology as "game-changing" for energy transition goals, pledging not just capital but engineering and project execution support.

Toward the 2030s

If SPARC achieves net energy and ARC delivers electricity to the grid, fusion will cease being a perpetual promise and become an industrial revolution.

"Backing Commonwealth isn't about chasing hype," said Maryanna Saenko of Future Ventures. "It's about supporting a team steadily advancing physics and engineering toward the most consequential breakthrough of our lifetime."

For now, the milestone is financial. With $863 million in new capital, CFS has extended its lead in a field that is rapidly consolidating around a few well-funded players. The theme emerging from Wall Street to Tokyo is clear: fusion is no longer a fantasy. It is a business.