Santos says Barossa remains on track for first gas by Q3 2025, just two days after Middle East O&G giant ADNOC lobbed its $32 billion takeover bid — as the BW Opal FPSO sails into position 285km north of Darwin.

The Barossa field is considered a strategic prize for ADNOC, offering 3.7 million tonnes a year of LNG and a cost-competitive gateway into Asia-Pacific export markets.

Santos and joint venture partners SK E&S and JERA have invested more than US$3.95 billion (A$6.07 billion) in the project to date.

Now with drilling delays behind it, Santos reports five of six production wells are complete, the fifth is undergoing flow testing, and final completion is due this quarter.

YOU MIGHT ALSO LIKE

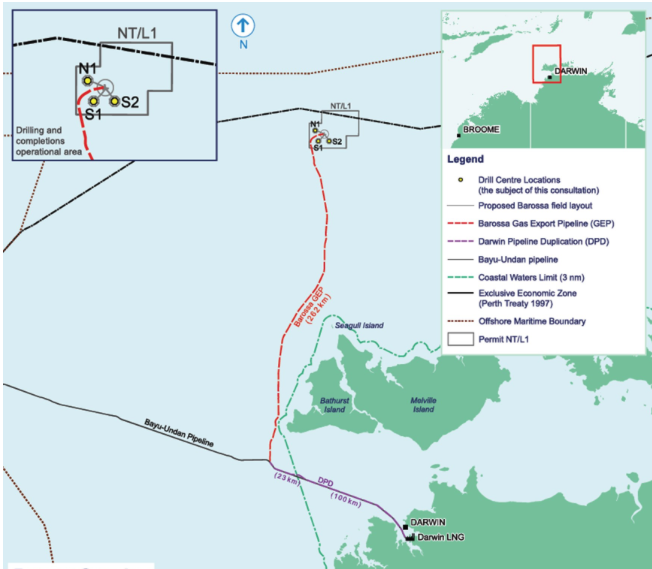

Meanwhile, 262km Gas Export Pipeline and 123km Darwin Pipeline Duplication, is in place.

Santos CEO Kevin Gallagher described the FPSO's arrival as a "significant milestone" for the long-delayed project, which received final investment approval in 2018.

"Barossa is a world-class asset and, together with Pikka Phase 1 in Alaska, is expected to deliver a 30% production uplift over the next 18 months," he said.

The Barossa LNG volumes are largely contracted, with offtakers including Mitsubishi's Diamond Gas, Hokkaido Gas, Shizuoka Gas, TotalEnergies and mining giant Glencore. Gallagher has reiterated that Barossa remains on track to be delivered within its US $4.6–5.8 billion cost guidance, despite legal challenges and earlier delays.

A $1 billion life extension of the Darwin LNG plant, required to process Barossa gas, is 90% complete.

The upgrade has supported about 300 jobs and is expected to deliver $100 million annually in supply and service opportunities to Northern Territory businesses.