The challenges of developing a viable carbon capture and storage (CCS) project have become apparent today with the withdrawal of INPEX's Bonaparte project from the federal government's assessment process. At the same time, Woodside lodges plan for an undersea investigation for its own Angel project.

As reported by ENB, INPEX referred its finalised plans for their 10 Mtpa CO2 storage project to the Department of Climate Change, Energy, the Environment and Water (DCCEEW) in November.

YOU MIGHT ALSO LIKE

The following month, DCCEEW announced it was suspending the referral and assessment process "by agreement with [INPEX]" until today. However, two days ago, INPEX withdrew the project from the process entirely.

In a statement, a spokesperson for the Japanese firm confirmed the unexpected move, adding the withdrawal was because of the reforms to the EPBC Act.

"INPEX confirms it has withdrawn its environmental referral submission for the Bonaparte Carbon Capture and Storage (CCS) Project while final amendments to the new Environment Protection and Biodiversity Conservation (EPBC) Act are being completed.

"As Operator of the Bonaparte CCS Project, INPEX remains fully committed to progressing the development and will resubmit the referral once the legislative amendments are finalised, in consultation with DCCEEW," said the spokesperson.

DCCEEW have today said they originally paused the assessment last month "to consider whether the referral as submitted should be assessed in full under the EPBC Act, or under a relevant strategic assessment agreement with the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA)."

"INPEX have indicated their intent to resubmit at a later stage. If INPEX resubmit, their proposal will be assessed under the government's reformed environmental laws," the DCCEEW spokesperson added.

DCCEEEW has a strategic assessment agreement with NOPSEMA to assess certain types of work. Included in the reforms to the EPBC Act passed late last year and which are due to come into effect next month were efforts to enable a clearer distinction of what components of CCS projects should be assessed by DCCEEW, and what should be assessed by NOPSEMA.

However, industry watchers are sceptical.

Kevin Morrison, the Australian gas energy finance analyst at the Institute for Energy Economics and Financial Analysis (IEEFA), said the pause and now withdrawal suggest the "Australian government has questions over the plan to dump a small proportion of its total emissions from the Ichthys LNG project in the Bonaparte basin offshore the Northern Territory."

"In our submission to the government, we said INPEX's proposal must still be considered to be at a preliminary stage as the project location has not been proven to be an identified greenhouse gas (GHG) storage formation, as required under Australia's Offshore Petroleum Greenhouse Gas and Storage (OPGGS) Act.

"It might be a procedural move but the fact the project was also at a preliminary stage may have been a factor too. INPEX's environment plan relied on dated material and didn't demonstrate a defensible storage case at the 8Mtpa proposed.

"Therefore, sustaining an EPBC process would be difficult. At that point, it's more a question of the project being ready rather than process, and pausing the process to strengthen the storage case is a rational outcome," he said.

Likewise, the Environment Centre NT (ECNT) went further, claiming the withdrawal is related to INPEX not properly disclosing the scale of a seismic survey, which would be needed.

In their submission, the ECNT highlighted what they called "a major inconsistency."

"INPEX said it would conduct seismic blasting over 1800 km² over 30 years, but its November referral report only evaluated impacts for a much smaller offshore area of 480 km² and the pipeline route.

"Federal environment guidelines require project proponents to disclose detailed information about seismic testing – including details of whale species likely to occur in the area and the location and timing of blasting," said an ECNT statement.

The ECNT's senior Climate Campaigner Bree Ahrens added: "This is a major setback for INPEX's carbon dumping plans, and it's troubling that basic details on seismic blasting are missing from the application.

"This carbon dumping project is a recipe for disaster, with deafening and deadly seismic blasting, a constant risk of spills and leaks."

The plan

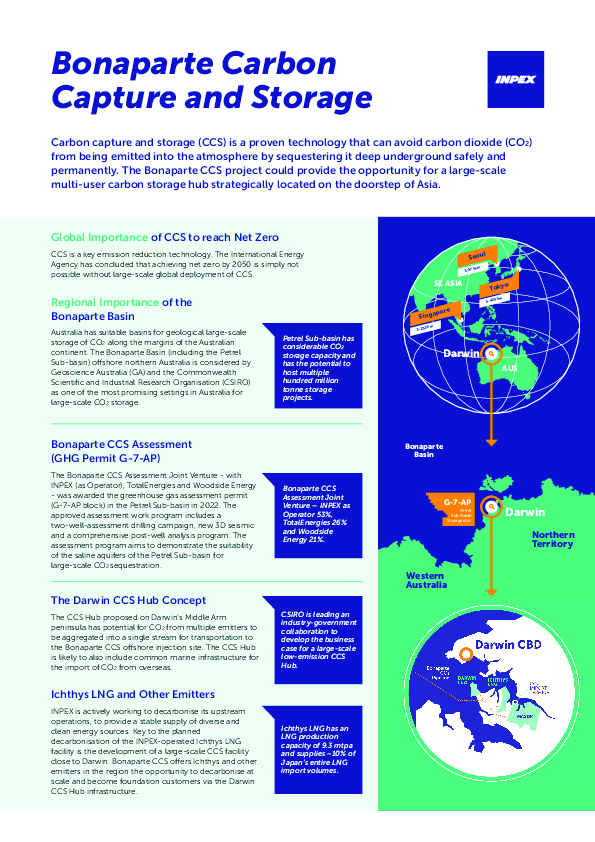

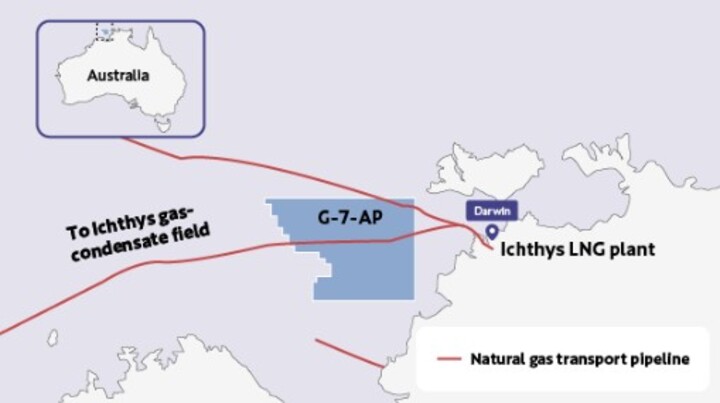

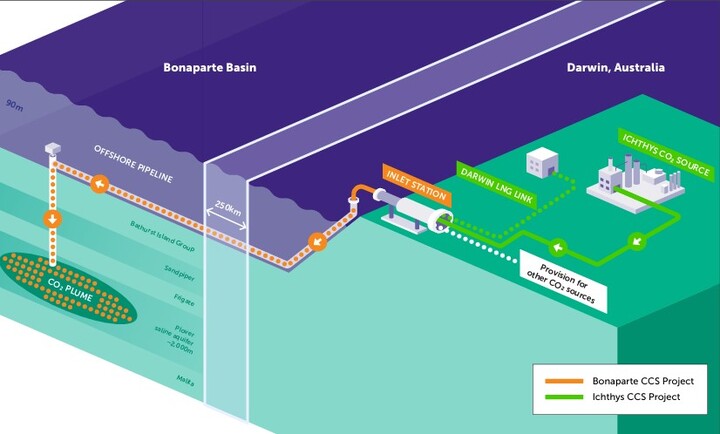

INPEX's plan would see up to 10 Mtpa of CO2 moved from Middle Arm via a 260km subsea pipeline to injection wells at an offshore storage site in the Petrel sub-basin in Commonwealth waters.

Phase one would enable 8 Mtpa, rising to 10 Mtpa in later phases, with 300 Mt stored over 30 years. Site works had been flagged for 2028, with operations from 2031.

Backed by INPEX alongside joint venture partners TotalEnergies and Woodside Energy, the plan was awarded Major Project Status last year. The plan also points to broader cross-border ambitions, with INPEX exploring Japan–Australia CCS projects and shipping CO2 for storage.

For INPEX, the CCS project is crucial to their efforts to decarbonise Ichthys LNG. It proposes developing a link into a wider offshore carbon capture and storage hub in northern Australia.

As well as referring the project for federal government assessment, in November INPEX also referred the plan to the Northern Territory's Environmental Protection Agency (NTEPA), which has also begun a public consultation, which ends next month.

Documents submitted for assessment under NT environment laws reveal INPEX plans to take its acid gas incinerators offline and to rely on CCS technology to address air pollutants from its Ichthys gas plant.

Referral documents submitted to the NTEPA reveal that if capture, transport and storage of CO2 and air toxics fail, INPEX will vent the toxic gas stream directly into the air.

Recent issues

The news comes in the shadow of several incidents that have drawn attention to the Ichthys plant in recent months.

Last November INPEX confirmed that a fire broke out at the site, triggering an immediate emergency response.

In October, INPEX admitted underreporting levels of dangerous chemicals like benzene, which jumped from 4.12 t to 556.9t — a staggering 13,400% increase. Other chemicals, like toluene and xylene, were also underreported.

Just days prior, there was also an oil spill at the site during LNG Train 2 commissioning, during which a heating medium fluid was released.

Heavy overnight rainfall overwhelmed a containment system, resulting in a mixture of heating medium and water spilling into the stormwater drainage and beyond the site fence. According to the incident report, the spillage remained on the premises, and INPEX initiated oil-spill response procedures.

Positive development for Woodside

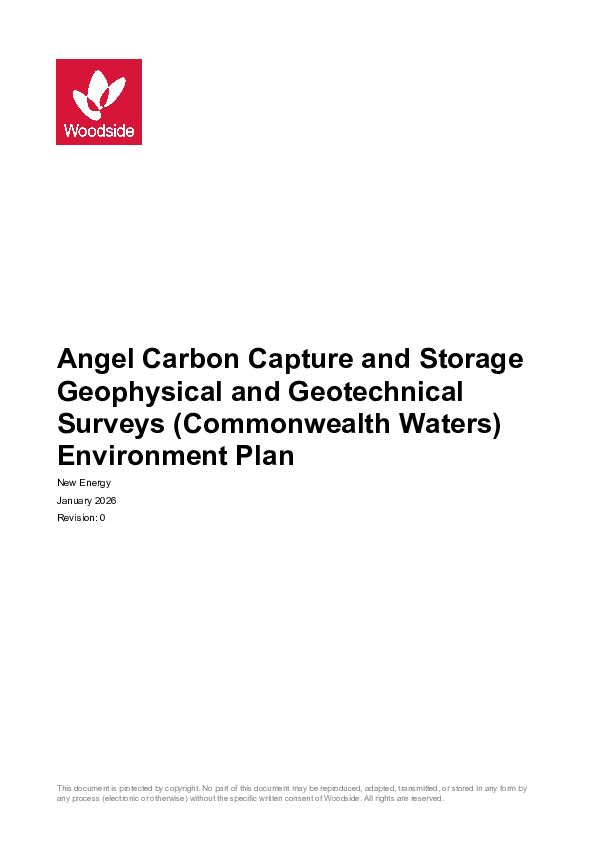

While INPEX appears to have hit a sizeable stumbling block on Bonaparte, its JV partner Woodside is pushing on with its own plans for the Angel CCS Project.

Woodside has submitted detailed authorisation documents to the federal government's offshore energy regulator – the National Offshore Petroleum Safety and Management Authority (NOPSEMA) – relating to plans to conduct geophysical and geotechnical surveys.

Data from the surveys would inform the design for the pipeline and umbilical routes, subsea structure foundation locations and planning for mobile offshore drilling unit anchoring or jack-up rig placements.

The Angel CCS Joint Venture, of which Woodside is the operator, involves the development of a CO2 gathering system that collects CO2 via new pipelines from onshore emitters or via imported vessels. Woodside plans that collected CO2 would be transported to a central compression facility, then transported offshore via a subsea pipeline and injected into a subsea geological formation.

Woodside says the operational area for the surveys on the Northwest shelf extends from the Commonwealth/State waters boundary to the Angel Field, located in GHG Assessment Permit G-10-AP. They have also outlined that a narrow corridor extending west out from the Angel Field to the petroleum title WA-1-L would also be surveyed.

A multi-purpose project vessel would be used to conduct the geophysical surveys, ROV operations and light geotechnical operations. Geotechnical drilling would be performed from a supply vessel using a seafloor drilling unit. Uncrewed surface vessels controlled from a remote operations centre could be used to replace conventional vessels for numerous survey tasks over the life of the EP.

Woodside wants to start the surveys as soon as possible and says the work may be completed over several multi-week campaigns split over a five-year period, with approximately 100 days of survey activities in total, and that the vessels involved will operate 24 hours a day.