A footnote in Viva Energy's half-year results has laid bare the energy retailer's dependence on refining profits, exposing earnings to swings in global crude and fuel prices and casting fresh doubt over funding for its proposed Geelong LNG terminal.

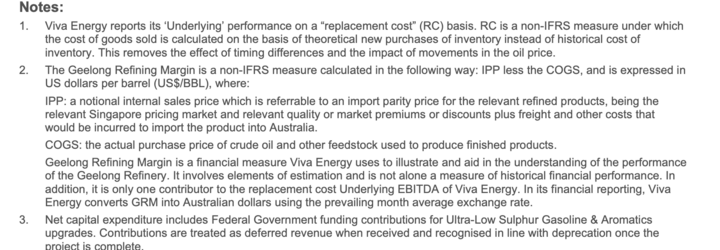

The Geelong Refining Margin – a non-IFRS measure that strips out timing differences to reflect import parity pricing – has long been the backbone of Viva's earnings.

But the measure is volatile and, as the results showed, heavily exposed to global cycles. Any sharp downturn could crimp cash generation and weaken the company's ability to self-fund or de-risk its LNG import project.

YOU MIGHT ALSO LIKE

Viva counters that refining is only one part of a broader portfolio.

Viva's head of strategy, Lachlan Pfeiffer, said the import terminal remained "significantly more capital effective than any other option" and was the only complete solution to Victoria's looming gas shortfall.

"Refining margins always have been and always will be an important part of Viva Energy's business; however, they remain one element of a much broader business which delivers a strong and stable return for shareholders," Pfieffer told Energy News Bulletin.

"Since 2021, the Australian Government has managed the Fuel Security Services Payment (FSSP) for domestic refiners through the Fuel Security Act. The FSSP secures Australia's long-term refining capabilities by underpinning production when refining margins are low."

Pfieffer added that third-party capital remained available, suggesting Viva could bring in partners or financiers to shoulder part of the investment.

Still, the Viva's half-year numbers were stark.

Net profit slumped 67% to $62.6 million, dragged down by lower sales and fuel margins at its convenience and mobility business as well as weak regional refining margins.

Group EBITDA fell 33% to $304.9 million. Convenience & Mobility, the once-reliable retail arm, posted a 39% drop in EBITDA to $74.4 million as both fuel and shop sales fell away. Energy & Infrastructure was even weaker, down 84% to just $18.4 million as refining margins collapsed.

Commercial & Industrial was the sole bright spot, holding EBITDA steady at $237.9 million, in line with the prior half. But its resilience only emphasised the fragility across the rest of the portfolio.

Today, Viva CEO Scott Wyatt acknowledged the first quarter had been "tough", but said momentum was improving. He pointed to progress in integrating the OTR retail network, with nine new stores opened by mid-August, contributing $46.4 million in second-quarter EBITDA through cost reductions and shared benefits.

Despite those gains, Viva was forced to slash its interim dividend to 2.83¢ a share, down from 6.7¢. The 50% payout ratio matched its policy, but highlighted the weaker earnings base.

With margins under pressure, retail volumes falling and balance-sheet demands rising, it remains to be seen if Viva can both maintain returns and bankroll a major new LNG terminal.