The Northern Endeavour is on its long and slow journey from Singapore to the Danish breakers yard, where it will be decommissioned, ENB can exclusively reveal today.

For the last few months, the much-loved floating production, storage, and offloading (FPSO) vessel has been in Seatrium's dry dock in Singapore, where it has been prepared for its journey to Modern American Recycling Services (MARS) 's shipyard in Denmark.

With its flare tower removed, tanks and hull cleaned and painted, and hull protrusions trimmed, the vessel is now on the back of Cosco's Hua Rui Long on the way to northern Europe.

It was back in September that the Northern Endeavour left the Timor Sea, where it had been for the last quarter century. After its nine anchor chains were cut, Normand Sirius towed it on the 18-day journey to Singapore.

YOU MIGHT ALSO LIKE

Now it is at the start of a much longer and final journey.

While the full route is unconfirmed, it has been confirmed the Hua Rui Long is currently in the Indian Ocean heading for the Suez Canal, due to arrive on 22 February. It will then pass through the Mediterranean, the Strait of Gibraltar, and likely up the coasts of Spain and France, through the English Channel into the North Sea, and then arrive in Denmark.

The news goes some way toward closing the book on the long-running saga of the dilapidated vessel, which for the last five years has been something of an albatross around the government's neck after it fell into their hands when its last owner went into liquidation.

P&A focus

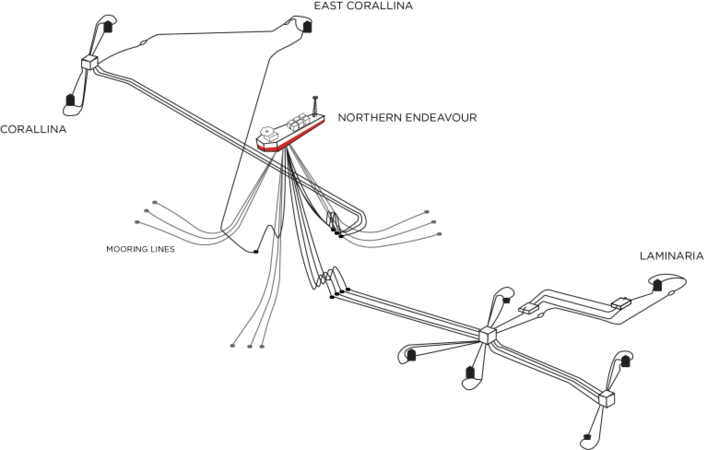

With the vessel now almost off the Australian government's desk, Canberra's attention is well and truly focused on decommissioning the subsea infrastructure in the Timor Sea.

Phase two of the Northern Endeavour decommissioning program stepped up a gear in September when the government launched a tender process for work to permanently plug and abandon wells in the Laminaria and Corallina oil fields.

Stage one involves the project management, engineering, logistics, regulatory approval, including achieving Registered Operator status, subcontracting, and procurement activities to design and plan to permanently plug and abandon the wells, develop a Stage Gate Review Pack outlining a pricing model with detailed budget, risk profile and performance management framework, and monitor and maintain the Laminaria Corallina oil fields.

Stage two is the real meat of the task. It involves permanently plugging and abandoning the wells, project management, engineering, procurement and field monitoring and meeting all regulatory requirements, including a National Offshore Petroleum Safety and Environmental Management Authority-approved safety case.

Court challenge

While it might look like a done deal, the legal and financial wranglings over the former FPSO Woodside workhorse are continuing.

Late last year, the liquidators of the company, which formerly owned the Northern Endeavour, were given more time to fight the government over the $1.1 billion they claim is owed.

Liquidators for Timor Sea Oil and Gas Australia (TSOGA), a subsidiary of Northern Oil and Gas Australia – the Angus Karoll-owned operation which bought the Northern Endeavour from Woodside in 2015 - believe the federal government owes them money for agreeing to hand over 30% of NOGA's tenements to Timor-Leste and for effectively shutting down the business. This move, they and Karoll believe, was unfounded.

In a Sydney courtroom in December, after hearing there are "multiple funders" willing to support the bid, Justice Stellios granted a request from Trent Hancock, representing the liquidators Jirsch Sutherland, for more time to prepare their case and secure the required funding.

In his ruling, Stellios said: "The extension will allow the applicants to continue their ongoing efforts to seek funding for the litigation to proceed. Failure to secure such funding will likely result in the proceeding being discontinued.

"The extension will allow the proceeding to proceed in a way that defers the accrual of legal costs (which is in the best interests of the first applicant's creditors), and minimises the impact on the resources of the Court, until it can be determined whether the applicants' prosecution of the claims is financially viable. In my view, an extension will facilitate the just and efficient resolution of the proceeding."

An extension until 1 April 2026 was granted.

Click here to read ENB's deep dive on the Northern Endeavour's history.