‘My career had been entirely focused on conventional international big-field oil and gas until I met Bruce McLeod, an industry veteran with a mathematics and economics background. In 1993, I was part of the exploration team that led BP into the Northern Caspian Sea, both in Azerbaijan and Kazakhstan. Eventually the massive Kashagan oil field was discovered with recoverable reserves of about 13 billion barrels of oil - the world's biggest oil discovery since the 1970s.

Bruce McLeod's knowledge of shale geology was cursory, but he knew Empire Energy's producing oil and gas fields in the US overlay prospective Utica Shale sequences in Pennsylvania and New York State.

Listen to Empire Energy's ENB Podcast

From about 2008 onwards, horizontal drilling with multi-stage fracking provided the breakthrough in the USA to enable commercial oil and gas production from tight shale rock, and Bruce had seen the dramatic impact of shale gas on the US economy and simply queried why that couldn't happen elsewhere.

The first thing Bruce asked me during our first lunch meeting in 2010 was ‘What do you know about shale?' That threw me a bit and I said ‘Well, to be honest Bruce, I've spent my life in conventional oil and gas, so I know pretty much nothing about shale other than as a conventional petroleum source rock'. Rather than being the end of the conversation, and to my surprise, Bruce said ‘So, when can you start?'

Cutting from Amoco's original report turned up by John Warburton in Darwin

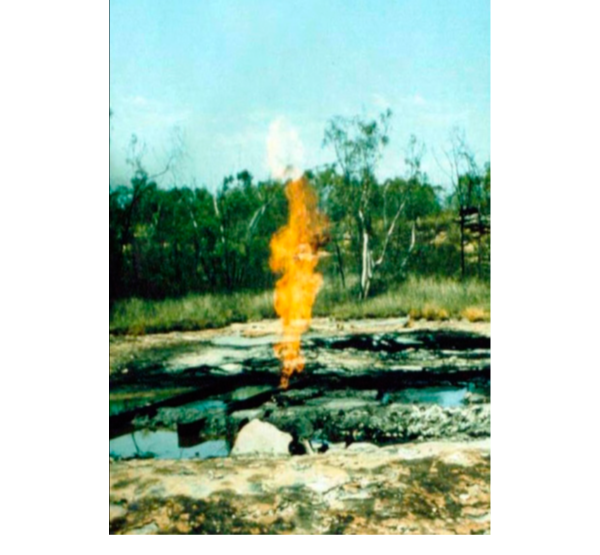

Amoco's GRNT-09 flaring

We agreed I would spend six months finding a shale play somewhere else in the world that Empire Energy could acquire and monetize.

In the previous four years I'd completed a major business development review of South East Asia for a multinational petroleum company. My mission had been to identify big conventional gas exploration opportunities that were geologically simple, easily developed, with a low entry cost, substantial acreage footprint, low fiscal risk and where there was a high chance of finding a super-giant gas field. It was a relatively quick task to screen the entire region once again, and essentially applying the same screening metrics, but this time with a view to shale plays.

Shale gas had been spoken about in Australia for at least a year by 2010 and I'd assumed all the prospective acreage would already have been snapped-up, but not so.

We wanted large contiguous areas at 100% equity, to allow ourselves to be unfettered by others. On the 24th March 2010 I planted myself in the Information Centre of the Northern Territory Geological Survey. One particular report described the results from a mineral well named GRNT-09. It had been drilled by Amoco Minerals in the Glyde Sub-Basin back in 1979 during their exploration for lead and zinc mineralization in the vicinity of what is now Glencore's zinc-lead McArthur River Mine in the McArthur Basin.

These metals were hosted in ancient black shale formations laid down in a relatively deep-water sedimentary basin an astonishing 1.64 billion years ago during the Palaeo-Proterozoic Era. If I may, I'll tell you a bit about how these extraordinary rocks formed.

They were of enormous interest to me as a petroleum man. The atmosphere of the early Earth from about 3.5 to 2.5 billion years ago had only a small fraction of the present-day oxygen level. That was because all the oxygen created by photosynthetic blue-green algae - at that time some of the earliest life-forms on Earth - was captured by iron in the oceans to form the thick banded iron-ore formations. After the free iron available in the early oceans was exhausted oxygen levels increased modestly until about 2 billion years ago and yet the oceans remained relatively ‘anoxic' - starved in oxygen.

Those conditions allowed for the preservation of organic carbon and the deposition of black carbonaceous, sulphide-rich black shales. The best analogue today is around the deep-sea ‘black smoker' hydrothermal vents where life thrives in the form of bacterial colonies, shrimps and crabs.

In the Proterozoic the dominant life form on Earth was prolific forming cyanophyte, or blue-green algal blooms. These rained in vast numbers onto the sea-bed forming layers of concentrated carbon in what become shale rock. The sulphide layers were interbedded with layers of black shale that was also raining down from the oceanic water column. And it still amazes me that world-class zinc-lead deposits can be interspersed with layers of world-class organic petroleum-prone black shale.

But the real lightbulb moment came as I ploughed through the completion report for the 1979 Amoco 534m deep GRNT-09 mineral well. The rig had struck a layer containing natural gas and caught fire! It was a mineral well so didn't have sophisticated blow-out preventers that are requisite on petroleum wells. A grainy photo of the flaming gas showed it blew six meters or so into the air and had a yellow smoky appearance indicating the gas contained condensate liquid or light oil.

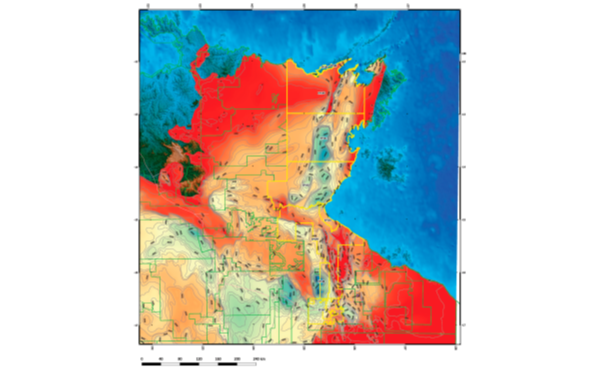

A map with the Empire tenements in yellow

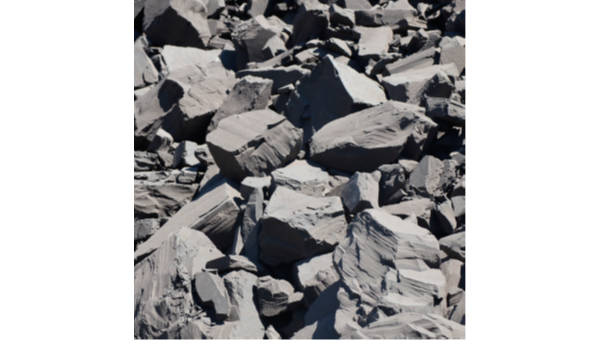

Tight shale' in the pit at McArthur open-cut mine where oil and gas have largely been vented to the atmosphere over time

The well burned into the wet season until the hole had filled with water and the gas escape was reduced to bubbles. Somebody in Amoco had the presence of mind to sample that gas which comprised about 75% methane plus heavier components of C2 to C8 and with very little carbon dioxide contaminant. It had intersected a viable petroleum source in the Barney Creek Formation which had been historically mined for lead and zinc. I simply then used the Northern Territory Survey geological maps to track the geographic distribution of that rock formation.

I phoned Bruce and said ‘Look, we are potentially onto a winner here, this is a shale play that fits all our screening metrics'. As far as I was aware at the time nobody else had spotted it. This was what we'd been looking for. An aerially extensive, proven gas and liquids-rich petroleum system in our own ‘back-yard', not overseas.

The Barney Creek Formation was estimated by the Survey Geologists to be up to 900 meters thick in places, almost an order of magnitude greater than many of the US shale fields. The area that contained the Barney Creek Formation was mostly flat, sparsely vegetated stony land with little agricultural potential, so subject to Traditional Owner approval, the play could be accessed, exploited and remediated quite easily. On the 26th March 2010 I applied for seven license areas occupying 59,000 square kilometres, or about 5% of the entire onshore Northern Territory - an area about the size of Croatia.

At the time that I was submitting Empire's License Applications a competitor, Armour Energy, unknown to us was also active. Amour's presence became evident when two of the areas for which I had submitted applications were refused by the Northern Territory Petroleum Licensing Department. Evidently, and just days before, Armour had also submitted applications for the same two licenses to the south of Empire's acreage.

Armour Energy has since drilled a number of successful exploration wells, including one with a horizontal leg. Those wells have confirmed the Barney Creek Formation shales, despite being 1.64 billion years old, are a prolific and potentially commercially viable petroleum system. Being exceedingly old, almost one-third of the age of the Earth itself, such ancient rocks like these have typically been deeply buried, suffered recrystallization or even melting depriving them of any petroleum.

The rocks of McArthur and Beetaloo Basins have never been buried so deep as to ruin their petroleum prospectivity. It is very clear that during their history they experienced just the right pressures and temperatures for petroleum generation and preservation - almost like a petroleum Goldilocks zone.

ABOUT THIS COMPANY

Empire Energy

Empire Energy Group Limited is a publicly listed oil and gas exploration and production (E&P) Company focused on onshore long-life oil and gas fields.

HEAD OFFICE:

- Level 1901, 20 Bond Street, Sydney, NSW, 2000, Australia

- Tel: 292511846

- Website: empireenergygroup.net/

- Email: info@empiregp.net