1352 AWST

What's the treasurer Jim Chalmers said?

As the federal government's treasurer it is Jim Chalmers who will have the ultimate say on whether the takeover can proceed.

It's still early days in the review process for the proposal which will be scrutinised by Foreign Investment Review Board (FIRB), Australian Securities and Investments Commission (ASIC), the National Offshore Petroleum Titles Administrator (NOPTA), and competition watchdogs in Papua New Guinea and the United States.

YOU MIGHT ALSO LIKE

However, Chalmers will make the captain's call but speaking to the ABC he's clearly keeping his thoughts to himself.

"First of all, there will be a range of views, including the South Australian Government's. I think it's appropriate that people express a view. This is potentially a very large transaction. There are, as I understand it, still a number of steps that need to happen before it becomes a transaction," said Chalmers.

"I will listen very closely, if it comes to it, to the advice of the Foreign Investment Review Board, but I won't pre‑empt that advice.

"...As the custodian of the foreign investment regime, someone who's asked from time to time to make decisions, including big decisions like this could potentially be, that it's not a good idea for me to pre‑empt the FIRB advice. I don't intend to do that in this case. People will have a view. I welcome people expressing their view.

"I'm unable to, because I may have to make a decision on this at some stage. It would be a big decision, and I do intend to take the FIRB advice seriously, and I don't intend to pre‑empt that advice," he added.

1334 AWST

ENB analysis: Energy lobby yet to weigh in on $32b Santos deal

Australia's peak oil and gas lobby, Australian Energy Producers (AEP), is yet to state its position on the proposed $30 billion takeover of Santos by Abu Dhabi's ADNOC-led consortium—despite mounting questions over domestic gas supply and national interest.

While AEP, with Santos boss Kevin Gallagher a current director, has previously stressed the importance of reliable and secure energy for Australian households and industry, it has remained silent on the potential implications of foreign state ownership of one of the nation's largest gas producers.

The deal comes amid rising concern over forecast gas shortages on the east coast, with the Australian Energy Market Operator warning of possible supply gaps from 2027 if new developments such as Santos' Narrabri project are delayed or shelved.

AEP has in past policy submissions cautioned that regulatory settings must support investment in both domestic supply and export markets, but has stopped short of opposing foreign investment. It also emphasised that Australia must remain an "attractive destination" for global capital.

The peak body's response to the ADNOC proposal could prove influential, particularly as Treasurer Jim Chalmers prepares to apply the national interest test under the Foreign Investment Review Board process.

Until then, the industry will be watching closely to see whether AEP will back the transaction—or raise concerns over Australia's energy sovereignty.

1300 AWST

Santos sale triggers national interest test amid gas supply fears

The nation will be looking to Jim Chalmers, who holds the key as FIRB weighs foreign bid's impact on domestic prices and security.

The $32 billion takeover bid for Santos by a consortium led by Abu Dhabi's ADNOC has ignited a high-stakes national interest test, with Treasurer Jim Chalmers to decide whether foreign ownership of Australia's second-largest oil and gas company passes muster.

The all-cash offer of $8.89 a share — a 28% premium — has been cheered by Santos shareholders, but now faces close scrutiny by the Foreign Investment Review Board. The key question: Will the deal help or hinder domestic gas security and household energy bills?

With the Australian Energy Market Operator (AEMO) warning of looming east coast gas shortages, attention is turning to Santos' $3.6 billion Narrabri gas project, which recently cleared its final Native Title hurdle. The project is expected to supply up to half of NSW's gas demand, but fears have emerged that a foreign-controlled Santos may delay or sideline the development in favour of its LNG export assets.

MST Financial energy analyst Saul Kavonic said the deal could clear the FIRB if the consortium agrees to ringfence local supply. "Narrabri will be the flashpoint — they may need to commit to domestic carve-outs," he said.

Analysts at Rystad Energy added: "FIRB scrutiny will be intense given the state-owned nature of ADNOC, sensitivities around gas exports, and strategic tensions including AUKUS. The presence of Carlyle does help position the bid as commercially driven, but conditions on domestic supply, governance, or even decommissioning could be required."

While the Santos board has endorsed the bid, the ultimate decision rests with Chalmers. A tick would offer the Albanese government a win on foreign investment and supply certainty. A knock-back would signal a more hawkish stance on strategic energy assets.

1236 AWST

Not everyone's a fan of the idea

In the wake of the announcement of the proposed takeover deal, Australian stockbroker Evans & Partners has released a research report in which it downgraded its rating on Santos from "positive" to "neutral."

According to media reports, the E&P research references previous releases that considered other major energy companies like France's TotalEnergies, the UK's BP and US-based ConocoPhillips as the potential "stand-out" likely new owners if Santos is to be taken over, citing "asset overlap and recent trends."

The report's authors say energy majors want to increase their exposure to LNG with the fuel increasingly being viewed as a key "transition fuel over the medium to long term.

In terms of a rival bid, E&P rating downgrade suggests that's unlikely.

In fact, E&P recommended clients consider taking profits on their Santos shares and switching into Woodside.

"We would advise investors to switch into Woodside which has better oil price leverage and catalysts," the broker said, backed by their estimates that that each US$10/bbl move in the crude oil price equates to an approximate 40% change in Woodside's net profit.

1226 AWST

Union reacts to deal proposal

The Offshore Alliance has used its Facebook page to wade into the debate regarding the possible Santos takeover with the subtlety of a size 11, steel toe capped boot.

"It's difficult to assess at this stage whether anyone working on a Santos facility will notice any difference with a Middle East mob running the show, given the sh**show which Santos use as their standard operating procedures.

"Santos oil and gas facilities are a death trap with maintenance standards being the worst in the industry and pay rates being third rate - at best.

"The Offshore Alliance will be asking the Federal Government to get assurances from ADNOC that they commit to decommission all non-operational Santos facilities - including Bayu Undan and don't simply cut and run and leave Australia and Timor Leste with a mess to clean up at the taxpayers' expense."

1008 ASWT

Deal raises concerns over decommissioning

An environmental group the Wilderness Society says any takeover of Santos must include considerations to ensure that Santos' decommissioning liabilities are taken into account.

Wilderness Society Fossil Fuel Industry Campaigner Fern Cadman says: "The Wilderness Society is concerned that if Santos sells out to a non-Australian listed foreign owned consortium, the end result will be less transparency and heightened risk that decommissioning won't get done and the marine environment and tax payers will bear the consequences."

Santos has been one of Australia's largest offshore operators for decades and now faces significant decommissioning responsibilities and costs. The Wilderness Society is calling for a comprehensive, independent and publicly disclosed assessment of Santos' current decommissioning liabilities at field and operation levels.

"This isn't just a corporate transaction—it's a test of whether Australia is serious about managing the massive clean-up required in our oceans. Regulators need to understand the billions in liabilities on the line and make it crystal clear that any purchasing companies are expected to deliver timely and environmentally safe decommissioning," said Cadman.

"The last thing we need is many more Northern Endeavours, where polluting infrastructure lands with the government because an Australian company sold out and the purchasing company never intended to get the clean up done."

Last August Santos unveiled detailed plans to decommission its assets in the Van Gogh, Coniston, and Novara fields, as well as its Ningaloo Vision floating production, storage, and offloading (FPSO) vessel.

Last October ENB reported that Santos had been approved to decommission one of its facilities off the coast of WA, leaving hundreds of tonnes of decaying material on the seabed.

The environmental plan (EP) submitted by Santos to the National Offshore Petroleum and Safety Management Authority (NOPSEMA) includes proposals for the continued operation of the Mutineer, Exeter, Fletcher, and Finucane (MEFF) facilities during the cessation period.

0951 AWST

South Australian government reaction

The government of South Australia, where Santos is based, says they will move to ensure the gas giant's HQ remains in Adelaide.

Despite the fact the XRG statement said there were no plans to relocate the companies headquarters, the state's premier Peter Malinauskas has made his position emphatic.

"The State Government's priority at all times is to ensure that South Australian jobs remain in South Australia, and to maintain Santos' headquarters in Adelaide," he said.

Having been briefed by XRG on the plan, he added: "We welcome the opportunity to continue this positive engagement. Any judgements we make regarding this process will be made in the state's best interests."

The SA government has recently passed changes to their Petroleum and Geothermal Energy Act to ensure that any application for approval of a change in the holder of a licence under the Act must be approved by the Minister. This legislation gives the State Government leverage to ensure the State's interests are properly served in the event of any change in ownership.

The state's energy minister Tom Koutsantonis said this move gave the government a seat at the table as negotiations proceed.

"Just as Santos must act in the best interests of its shareholders, the SA Government will act in the best interests of South Australians.

"There are levers available to the State Government to ensure that the State has a say in this potential takeover, and our main objective will be to safeguard Santos jobs and retain its headquarters in SA. Legislation passed by this Government ensures that Ministerial approval is required for a change in the controlling interest of a licence holder.

"We will be looking at this proposal carefully and engaging constructively with the proponents."

1536 AWST

Rystad Energy analysis

Krishan Pal Birda, Vice President, Oil & Gas Research, Rystad Energy:

"ADNOC has been actively working to expand its footprint in the global LNG business with investments in the United States via the Rio Grande LNG facility, farm-in to Mozambique's Area 4 concession in Africa through XRG. Through XRG, it's targeting 20–25 million tonnes per annum of LNG capacity by 2035 — and acquiring Santos would give it an immediate foothold in Asia-Pacific's LNG corridor. Santos produced around 5 Mtpa of equity LNG last year and could produce up to 8 MT by the end of this decade if the capital war chest is deployed to develop Papua LNG and hit capacity at GLNG, fitting neatly into XRG's ambition.

"Strategically, this is about diversification — ADNOC gains exposure outside the Middle East, in a stable regime, non-OPEC, non-conflict gas exposure with direct access to Asian markets. For Santos, this offer arrives at a critical juncture. With multiple capital-hungry projects and investor pressure to unlock value, deep-pocketed backing from ADNOC could unlock long-stalled growth.

"The key hurdle now is regulatory. FIRB scrutiny will be intense given the state-owned nature of ADNOC, sensitivities around gas exports, and a political backdrop shaped by AUKUS and strategic infrastructure concerns. The inclusion of Carlyle in the consortium helps reframe the deal as balanced and commercially driven, but conditions — around domestic gas, governance, or even a local decommissioning industry — are on the cards.

"Counterbids are unlikely at this point. Santos has long been in play, but few global players have both the appetite and strategic need that ADNOC does today. If cleared, this deal could reshape Australia's gas sector and mark the start of a broader LNG expansion for XRG backed by ADNOC.

"Other caveats to look out for if it goes through: JV partners exercising pre-emptive rights in the LNG projects, potential spin-offs or asset sales of late-life domestic gas assets."

1419 AWST

Global implications

1325 AWST

ENB analysis: Santos buyout - a red flag for Australia's energy security?

Adnoc's bold $32 billion tilt at Santos has set tongues wagging, not just in boardrooms, but in Canberra too. The big question? What will the Foreign Investment Review Board (FIRB) make of an Abu Dhabi state-owned entity taking control of a major Australian gas producer at a time when energy security is once again front and centre.

It's not just about the money. The geopolitical backdrop — Middle East conflict, supply chain shocks and rising east coast gas shortfall warnings — adds layers of complexity to any approval process. And the memory of past rejections still lingers.

Rewind to April 2001: then-Treasurer Peter Costello blocked Shell's $5 billion bid for Woodside, citing the national interest. That decision stunned the market. The Australian dollar sank a cent on the news. Shell had argued it could enhance the nation's energy security. Costello wasn't convinced.

Two decades later, the context has shifted, the players have changed, but the core concerns remain: who controls Australia's critical energy infrastructure?

And can they be trusted to prioritise national needs over external agendas?

There's irony, too. It wasn't long ago that Woodside itself was seen as a logical acquirer of Santos — a more politically palatable move, one might argue, than foreign control. But ENB thinks that ship may have well and truly sailed?

ENB also reckons we could be heading for a test case of the Albanese government's appetite for foreign capital in strategic sectors. Will energy security trump investor sentiment? And what signals will this send to others circling Australia's resource assets?

1304 AWST

Who and what is XRG?

XRG is an investment company which was launched in November last year following the endorsement from Adnoc and is described as a "groundbreaking international lower-carbon energy and chemicals investment company, with an enterprise value of over $80 billion."

The consortium has stated it aims to more than double its asset value in its first over the next decade by "capitalizing on demand for low-carbon energy and chemicals driven by three megatrends: the transformation of energy, exponential growth of AI, and the rise of emerging economies."

Building on Adnoc's expertise , XRG's initial focus since launch has been:

- XRG's Global Chemicals platform - aims to be a top five global chemicals player, producing and delivering chemical and specialty products essential for modern life, to meet the projected 70% increase in global demand by 2050.

- XRG's International Gas platform - will build a world-scale integrated gas portfolio to help meet the anticipated 15% increase in global natural gas demand over the next decade, as a lower carbon transition fuel, and the expected 65% increase in demand for LNG by 2050

- XRG's Low Carbon Energies platform - will invest in the solutions needed to meet increasing demand for low carbon energies and decarbonization technologies to drive economic growth through the energy transition. The market for low carbon ammonia alone is expected to grow by between 70-90 million tonnes per annum by 2040, from close to zero now.

At its launch, Dr. Sultan Al Jaber, ADNOCs' MD and group CEO, said: "In line with our Board mandate to prioritize transformational growth, XRG marks a bold new chapter for ADNOC. Building on our unrivalled track record in energy and investments, network of global partners, and strategic market access, XRG will drive sustainable economic growth, foster technological innovation, and deliver the energy and products needed to improve lives around the world. We are committed to delivering long-term value for our stakeholders and reinforcing Abu Dhabi and the UAE's role as a global energy and chemicals leader."

XRG only formally started its activities in the first quarter of this year.

1141 AWST

Takeovers reviewed on "case-by-case basis"

The issue of whether this takeover would be a good thing for Australia will be central to whether it progresses.

In a brief statement a spokesperson for the Tresurry department told ENB: "Foreign investment matters are reviewed on a case-by-case basis to ensure the investments are not contrary to the national interest or national security (as the case requires).

"Due to protected information provisions under the Foreign Acquisitions and Takeovers Act 1975, including information that is commercial-in-confidence, the Government cannot comment on the application of the foreign investment screening arrangements as they apply or could apply to particular investments."

1118 AWST

Not in Australia's national interest

Tim Buckley, the director of Climate Energy Finance, asks: "How is a takeover of Santos by a state owned enterprise in the Middle East remotely in Australia's national interest?

"Abu Dhabi National Oil Company controlling Australia's second largest methane gas producer and exporter? Enabling the Santos CEO to extract a fat takeover premium as he sales off into retirement?

"Treasurer Jim Chalmers and the FIRB will have to decide if foreign state owned enterprises that are massive direct competitors to Australia are able to wade in and buy key strategic monopolistic assets in Australia.

"Australian domestic energy users are already being gouged daily by the multinational gas cartel.

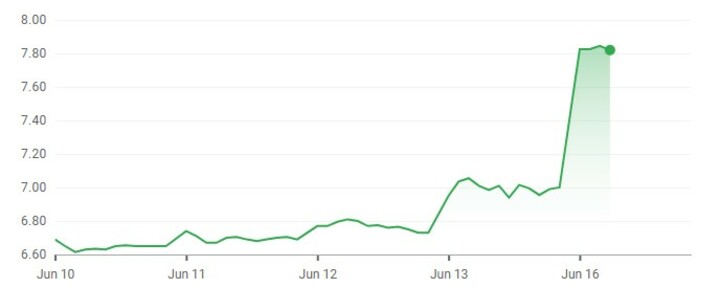

"The muted rally in Santos' share price on Monday morning tells the story. The stock rose just 12% to $7.82, 14% below the offer price – and that move includes the tailwind of surging oil prices due to the conflict between Israel and Iran. Investors clearly see an awful lot of completion risk in this deal."

1033 AWST

XRG consortium's statement in full

1028 AWST

Santos' statement in full

1019 AWST

Will the government accept foreign ownership of Santos?

One of the big questions is whether the government will accept Santos moving into foreign ownership. A sale to a consortium led by Abu Dhabi government interests will see the overwhelming majority of Australia's oil and gas reserves held by foreign interests.

The Australian government has history in this space - John Howard's treasurer Peter Costello blocked Shell's proposed takeover of Woodside in the early 2000s on the ground of national/energy security.

Kevin Morrison at the Institute for Energy Economics and Financial Analysis said: "The Australian gas industry likes to talk about energy security, now executives from Australia's second largest listed gas producer Santos Ltd will be arguing that the government and regulators should allow it to be sold to a company controlled by a foreign government that is located in one of the most sensitive energy geopolitical regions in the world."

1009 AWST

Analysts and corporate experts weigh in on the possible takeover

1007 AWST

Santos' shares on the ASX soar on news of potential takeover

1000 AWST

Slugcatcher calls it: 'Game On'

From the sidelines, Slugcatcher watches as Adnoc's $30b tilt at Santos reignites national security jitters, puts pressure on the Albanese government—and sets the stage for a potential bidding war.

"If it wasn't acceptable to the Australian Government a few years ago for the big Anglo/Dutch oil company Shell to own Woodside, Australia's biggest oil company, will it be acceptable for a Middle East country to own Santos, Australia's second biggest oil company, says Slugcatcher.

"That's one of many questions being asked after Abu Dhabi's national oil business Adnoc lobbed a $30 billion takeover bid for Santos.

"Time's change and oil is no longer seen by some people in government as a critical commodity needed to fuel the economy.

"But, with the threat of a widespread Middle East war growing out of the current Iran/Israel clash the issue of national security will land on the desk of the Prime Minister, Anthony Albanese.

"The Adnoc bid also has the potential to flush out a rival offer, including a return to the table by Woodside which has tried in the past to acquire Santos.

"Clear winners so far are Santos shareholders from this latest attempt by an outsider to buy the Adelaide-based business which has beaten off repeated takeover proposals dating back to the 1970s when the late Perth entrepreneur Alan Bond stirred a hornets nest with a bid for Santos.

"That Bond bid caused Santos to retreat into its Addelaide comfort zone, protected by South Australian anti-takeover laws.

"Once Santos lost its legal umbrella it has only been a matter of time, government acquiescence, and the right price, for the company to be acquired.

"Whether Adnoc is offering the right price is the first question of today's bid from Adnoc.

"Whether government approval will be forthcoming is the second question, and whether the price is right is the third question.

"Game on."

0836 AWST

ADNOC's shock Santos bid blindsides energy sector

Santos has received a surprise $32 billion takeover proposal from a consortium led by XRG P.J.S.C., a subsidiary of Abu Dhabi National Oil Company (ADNOC), along with Abu Dhabi's ADQ and global private equity firm Carlyle.

The non-binding and indicative offer, submitted on June 13, proposes a cash price of US$5.76 (A$8.89) per share via a scheme of arrangement — a 28% premium to Santos' last traded price of $6.96. The proposal follows two earlier bids in March at lower valuations and is now framed as the consortium's "final non-binding indicative" offer.

The return of the suitors — after weeks of silence — has caught many in the industry off guard and marks one of the largest potential transactions in the Australian energy sector in recent years.

The proposal remains subject to confirmatory due diligence and the negotiation of a binding Scheme Implementation Agreement (SIA). It would also require regulatory clearances from FIRB, ASIC, NOPTA, and competition watchdogs in Papua New Guinea and the United States.

Santos' board has granted due diligence access and is negotiating a Process and Exclusivity Deed with the consortium that would lock out rival bids during the next phase of talks. The board, advised by Goldman Sachs, JB North & Co, and Herbert Smith Freehills, has indicated it will unanimously support the deal if a binding agreement is struck, in the absence of a superior proposal and subject to independent expert endorsement.

There is no certainty the talks will result in a formal transaction. Rothschild & Co is acting as independent adviser to the board.