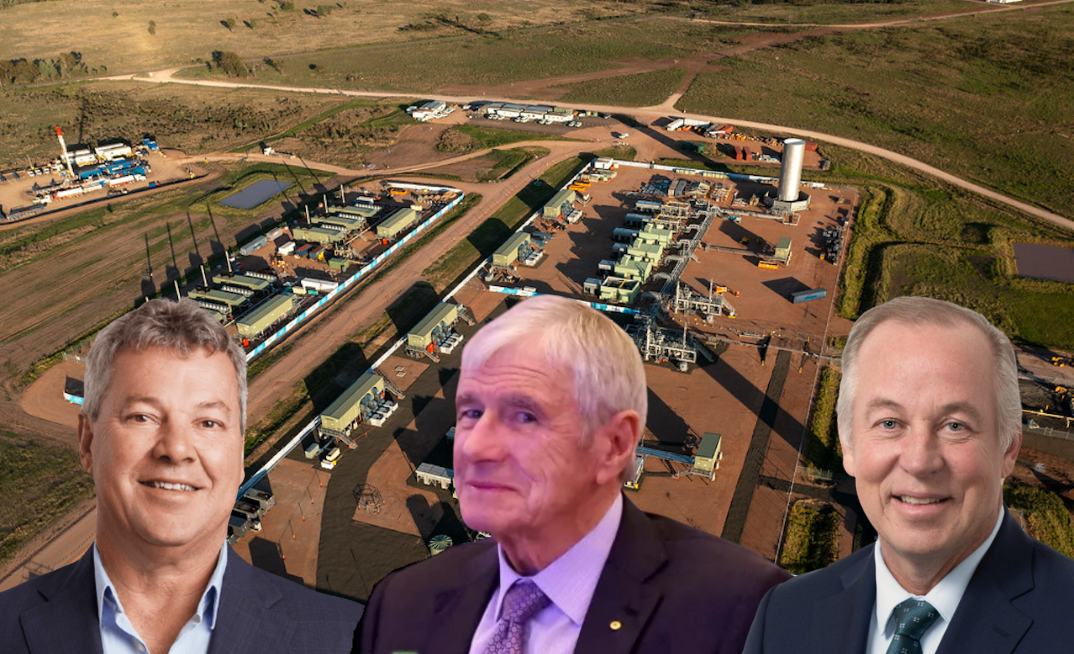

A bitter divide has erupted between Australia's manufacturing and gas industries over how to tackle soaring energy costs, with BlueScope Steel, Beach Energy and Seven Group Holdings (SGH) offering starkly different prescriptions for reform.

At the National Press Club today, BlueScope CEO Mark Vassella warned government inaction on gas supply and prices risked sending manufacturing "toward a collapse not seen since the UK steel industry in the 1970s."

He accused state and federal governments of an "unwillingness" to enable new developments and "self-serving" gas companies of exploiting distorted markets, urging temporary gas price controls under the National Gas Market Review to protect industrial users and preserve jobs under the Future Made in Australia policy.

YOU MIGHT ALSO LIKE

Gas producer Beach Energy hit back almost immediately.

CEO Brett Woods said manufacturers' calls for price-setting were "overly simplistic" and would "stymie exploration and production" at a time when Australia desperately needs new supply.

"Timelines from discovery to first gas continue to lengthen while uncertainty around policy settings adds significant cost and risk to investment decisions," Woods said.

"Gas exploration in Australia has decreased by 74% during the past decade. Any further economic constraints will only deliver less natural gas to manufacturers, businesses and households."

Woods warned "arbitrary market intervention does not work" and urged manufacturers to invest upstream alongside producers rather than seeking regulatory fixes.

Amid the escalating policy clash, Seven Group Holdings — the dominant shareholder in Kerry Stokes' Australian Capital Equity and a major investor in both manufacturing and gas through Beach Energy — struck a more pragmatic middle ground.

SGH stated that it relies on Australia's energy system and believes that supporting new gas supply, rather than price controls, is fundamental to safeguarding the country's manufacturing base.

"Price caps and other market interventions are short-sighted, putting future energy security and jobs at risk," SGH said.

"The real issue is supply. Unless this is addressed, no amount of price rhetoric or intervention will deliver the energy security we need to support Australian manufacturing."

SGH noted that Australian gas prices already rank in the lowest quartile of OECD nations, averaging 40% below export parity since 2023, and dismissed calls for price caps or subsidies.